Problem 6-18, Sudbury Mechanical Drifters

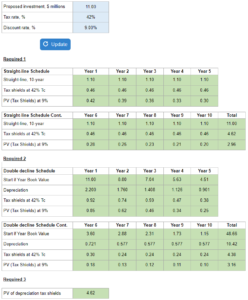

Determine the present value of Sudbury's depreciation tax shields and the present value of the tax shields assuming straight-line depreciation, double-declining depreciation, and immediate write-off of the factory assuming a 10-year life.

Experts Have Solved This Problem

Please login or register to access this content.