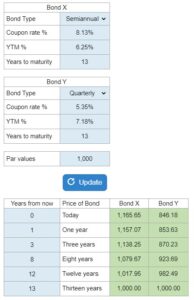

Problem 6.18 – Bond X Bond Y

What are the prices and expected prices of two bonds, Bond X and Bond Y, given their coupon rates, YTM, maturity, and par value, and what is the explanation for the differences in their prices over time? Determine the price of bonds X and Y today, one year from now, three years from now… etc. Fill out the grid.

Experts Have Solved This Problem

Please login or register to access this content.