Problem 6-15, Company A & B, Project with Accumulated Tax Losses

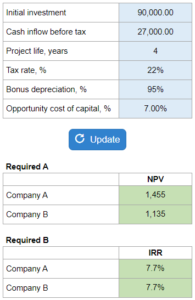

Given the initial investment on a project along with cash inflows before tax, tax rate, bonus depreciation, and opportunity cost... calculate the NPV and IRR for both companies A and B.

Experts Have Solved This Problem

Please login or register to access this content.