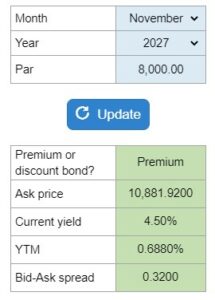

Problem 6.14 – Treasury Bond Using Figure 6.4

Given a particular date, determine whether the Treasury bond is a premium or discount bond, compute its current yield, yield to maturity, and the bid-ask spread.

Note: This is only relevant to the 11e of the book. Check your textbook edition and filter accordingly.

Experts Have Solved This Problem

Please login or register to access this content.