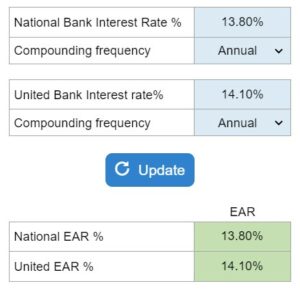

Problem 6.14 – EAR for First National Bank and First United Bank

How can you compare loans with different compounding periods, given their annual interest rates? Suppose there are two banks offering loans with different compounding periods and annual interest rates: Bank A charges X% compounded monthly, while Bank B charges Y% compounded semiannually. Which bank should you choose if you are a potential borrower? Calculate the EAR for the different banks.

Experts Have Solved This Problem

Please login or register to access this content.