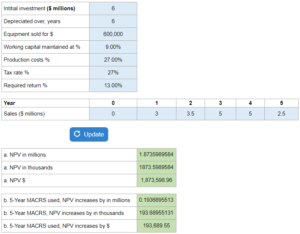

Problem 6-10, Better Mousetrap’s Project NPV

Determine the NPV for Better Mousetraps given a 5-years worth of sales forecasts and if the project is depreciated straight line. How much would the NPV of the project increase if the asset is depreciated using 5-year MACRS?

Experts Have Solved This Problem

Please login or register to access this content.