Problem 5.05 – Japanese Yen Forward

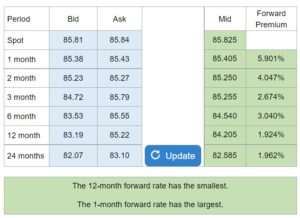

Compute the mid-rate quotes for the yen at various maturities, the annual forward premium or discount and then determine which maturity has the smallest and largest forward premium.

Experts Have Solved This Problem

Please login or register to access this content.