Problem 4-24, Growth-Tech

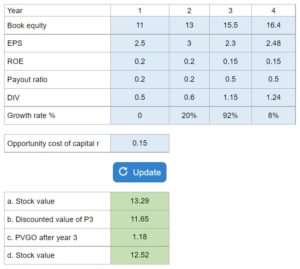

Given a table of data including book equity, earnings per share, ROE, the payout ratio, dividends per share, and the dividend growth rate, estimate the stock value, the discounted value of P3, and PVGO. Finally, assume that competition will catch up with Growth-Tech: reestimate the stock value.

Experts Have Solved This Problem

Please login or register to access this content.