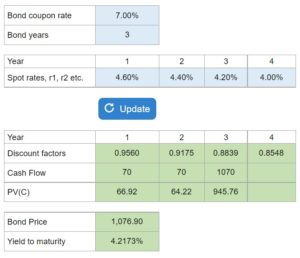

Problem 3-18 and 3-19, using Spot rates

Given a list of spot rates, calculate the discount factors, bond prices, and yields to maturity for various bonds. NOTE: They might ask you for 3 bonds, A, B, and C. Just update the top two inputs, the coupon rate and the total years applicable for each bond, and just press update. Do this for A, then B, and finally for C.

Experts Have Solved This Problem

Please login or register to access this content.