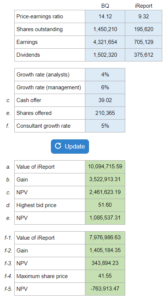

Problem 26.14 – Calculating NPV

Given price-earnings ratio, shares outstanding, earnings, dividend, growth rates, cash offer, shares offered, and consultant growth rate... figure out the value of the company, the gain, the NPV, the highest bid price, and the NPV with outstanding stock. Then rework with the new growth rate.

Experts Have Solved This Problem

Please login or register to access this content.