Problem 22-07, Valuing a Call Option on Mark II Investment

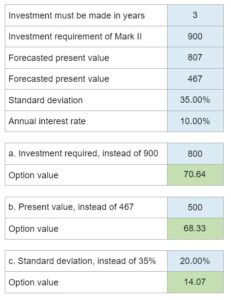

How do changing investment requirements, present value, and standard deviation affect the option value of investing in Mark II?

Experts Have Solved This Problem

Please login or register to access this content.