Problem 21-06, Buffelhead Could Halve of Double

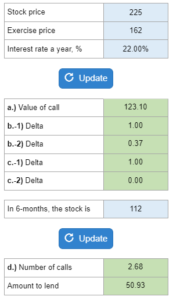

Given the stock price, exercise price, and interest rate... determine the value of the Buffelhead call, the option delta when a call is certain to be and not be exercised, and calculate the option delta for the second six months if the stock price rises and fall.

Experts Have Solved This Problem

Please login or register to access this content.