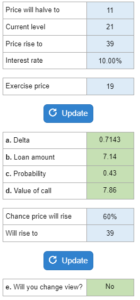

Problem 21-01, Ragwort Call Option

Determine the delta of a one-year call option, the risk-neutral probability that Ragwort stock will rise, and if you would change your view about the value of the option.

Experts Have Solved This Problem

Please login or register to access this content.