Problem 2.05 – Duela Dent Taxes

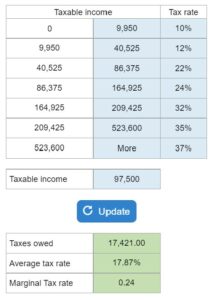

Given taxable income for a single individual, use the tax rates provided from table 2.3 to determine the taxes owed, average tax rate, and marginal tax rate.

Experts Have Solved This Problem

Please login or register to access this content.