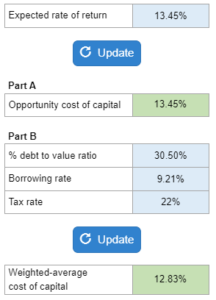

Problem 19-05, Whispering Pines Inc. Cost of Capital

Given the expected rate of return for an all-equity financed firm and ask you to determine the opportunity cost of capital. Then they give you the debt to-value ratio, the borrowing rate, and the tax rate... determine the weighted average cost of capital.

Experts Have Solved This Problem

Please login or register to access this content.