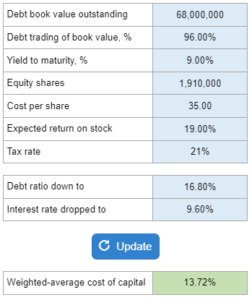

Problem 19-04, Federated Junkyard WACC

You are given the book value of debt and percent it is trading at, the yield to maturity, the shares of equity, the cost per share, the expected return, tax rate, and debt ratio. If the firm moves to a more conservative debt policy, calculate the new WACC using the three-step method.

Experts Have Solved This Problem

Please login or register to access this content.