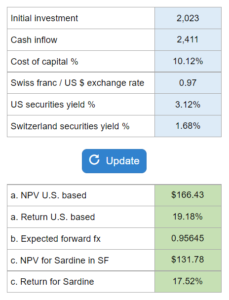

Problem 18.17 – Sandrine Machinery (Swiss Multinational Manufacturing Company)

Given the information on what the financial planners are considering undertaking... determine the net present value and rate of return generated by this project and the expected forward exchange rate in one year's time.

Experts Have Solved This Problem

Please login or register to access this content.