Problem 18.08 – Drake’s Bowling Alleys

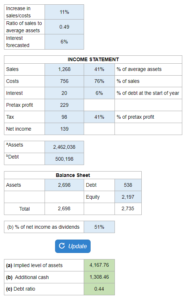

Given the data from the income statement, end-year balance sheet, and forecasted sales and costs... find the implied level of assets, how much cash is needed to raise in the capital markets, and the debt ratio.

Experts Have Solved This Problem

Please login or register to access this content.