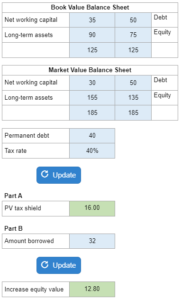

Problem 18-03, United Frypan Company (UF)

Given a book value and market value balance sheet along with permanent debt and the tax rate... determine the present value of the tax shields and the increase in equity value that results from taking on more debt.

Experts Have Solved This Problem

Please login or register to access this content.