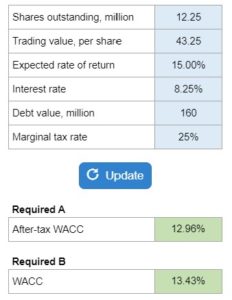

Problem 17-21, Omega Corporation WACC

Given the shares outstanding, trading value, expected return, interest rate, the value of debt, and marginal tax rate... determine the after-tax WACC, and the WACC if no debt was used.

Experts Have Solved This Problem

Please login or register to access this content.