Problem 17.12 – Consolidated Pasta

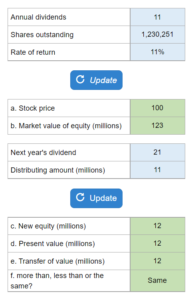

Determine the following for Consolidated Pasta: the price of stock, total market value of equity, how much new capital the company needs to raise to finance the dividend payment, the total present value of dividends, and the transfer of value from the old shareholders to the new shareholders.

Experts Have Solved This Problem

Please login or register to access this content.