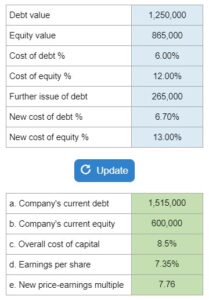

Problem 17-12, Buggins Inc.

Given the market value of the firm's debt and equity, and assuming the firm issues debt and uses the proceeds to repurchase equity, determine the amount of debt the firm has, the equity that it has, the overall cost of capital, the percentage increase in earnings per share and the new price-earnings multiple.

Experts Have Solved This Problem

Please login or register to access this content.