Problem 17-11, Spam Corp. Repurchases Shares

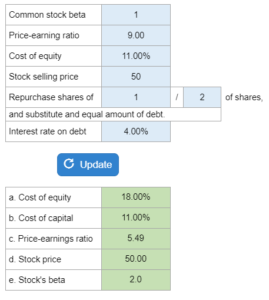

Given the following calculations for Cost of equity, the overall cost of capital, price-earnings ratio, stock price and stock beta

Experts Have Solved This Problem

Please login or register to access this content.