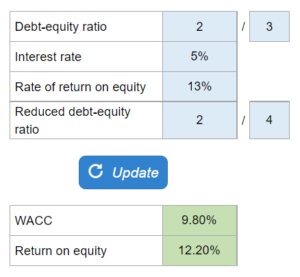

Problem 16.14 – Leverage and the Cost of Capital

Debt-equity ratio, interest rate, rate of return on equity, and reduced debt-equity ratio... calculate the WACC and expected rate of return on equity.

Experts Have Solved This Problem

Please login or register to access this content.