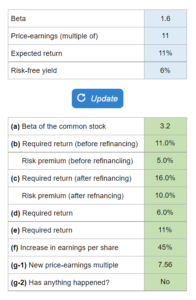

Problem 16.11 – Leverage and the Cost of Capital

Given the beta, price-earnings, expected return, and risk-free yield... calculate a through e, and f through g-2 if the EBIT remains constant.

Experts Have Solved This Problem

Please login or register to access this content.