Problem 16.09 – Homemade Leverage and WACC

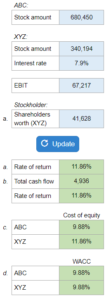

Given the information on ABC Co, XYZ Co, and the shareholder... figure out the rate of return for the shareholder, total cash flow and rate of return if he invested in ABC Co, and the cost of equity and WACC for both corporations.

Experts Have Solved This Problem

Please login or register to access this content.