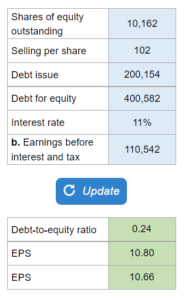

Problem 16.08 – Reliable Gearing

Given the information on the all-equity-financed company and its consideration of a capital restructuring... find the debt-to-equity ratio and earnings per share for both of the different borrowing amounts.

Experts Have Solved This Problem

Please login or register to access this content.