Problem 16.08 – Homemade Leverage

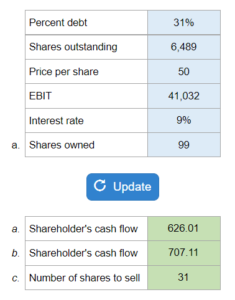

Given percent debt, shares outstanding, price per share, EBIT, interest rate, and shares owned... find out the shareholder's cash flow, their cash flow under the new capital structure, and the number of shares the shareholder should sell.

Experts Have Solved This Problem

Please login or register to access this content.