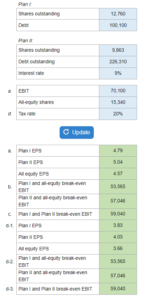

Problem 16.06 – Break-Even EBIT and Leverage

Given the information on the different capital structures (Plan I & Plan II)... figure out the EPS of each plan, the break-even levels of EBIT, and what level of EBIT will EPS be identical for the plans. After, redo these with the new given corporate tax expense.

Experts Have Solved This Problem

Please login or register to access this content.