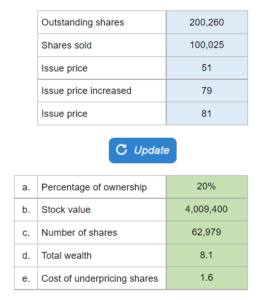

Problem 15.14 – Fishwick Enterprises

Determine the following for Fishwick Enterprises: percentage of the company she will own, what her holding will be worth, shares to sell to raise the same amount as IPO, her wealth, and cost of underpricing.

Experts Have Solved This Problem

Please login or register to access this content.