Problem 15.01 – IPO Underpricing Koepka Co

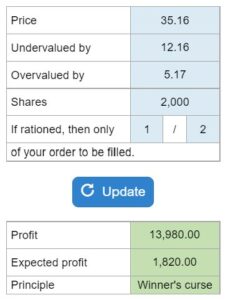

Two companies Woods Co. and Koepkta Co. (Or Johnson Co) have announced IPOs at the same price. One is undervalued and the other is overvalued, but it is unknown which is which. If you plan to purchase a certain number of shares of each company, determine your profit, and finally, state the principle illustrated by this situation.

Experts Have Solved This Problem

Please login or register to access this content.