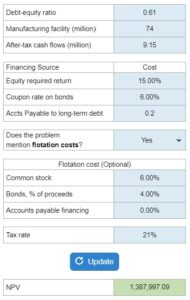

Problem 14.28 – Flotation Costs and NPV

What is the NPV of the manufacturing facility used to produce photographic equipment? You are given a debt-equity ratio, the cost of the new plant, the after-tax cash flows, and three financing options.

Experts Have Solved This Problem

Please login or register to access this content.