Problem 14.23 – Sage Company, Lou Barlow’s New Product Decision

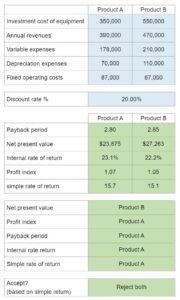

Calculate the payback period, net present value, internal rate of return, profitability index, and simple rate of return. Then find out which product is preferred, and which one should be accepted. Should Lou Barlow choose to manufacture and sell Product A or Product B for a five-year period, considering his annual pay raises are determined by his division's return on investment? The cost and revenue estimates for each product are given, and the company's discount rate is given. Calculate the payback period, net present value, and project profitability index for each product.

Experts Have Solved This Problem

Please login or register to access this content.