Problem 14.15 – Absence of Market Imperfections & Tax Effects

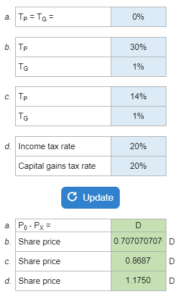

The share price may decline by the amount of the dividend payment when the stock goes ex-dividend, but this may not be the case when considering tax effects. A model has been proposed that takes into account tax effects on the ex-dividend price, including the personal tax rate on dividends and the effective tax rate on capital gains. Determine how much the share price will fall when the stock goes ex dividend given various values for TP ang TG.

Experts Have Solved This Problem

Please login or register to access this content.