Problem 14.14 – Gecko & Gordon Company

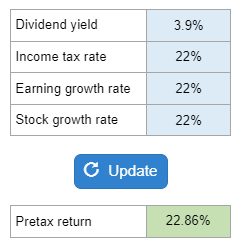

The Gecko Company and the Gordon Company have similar business risks and different dividend policies. Gecko has no dividends and is expected to have annual earnings growth, while Gordon has an expected dividend yield. If the aftertax expected returns on the two stocks are equal, what is the pretax required return on Gordon's stock?

Experts Have Solved This Problem

Please login or register to access this content.