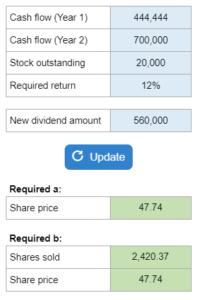

Problem 14.13 – Quick Buck Company

The Quick Buck Company is an all-equity firm that is expected to generate cash flows in years one and two, including proceeds from liquidation. The board of directors plans to pay a dividend next year and will sell new shares to raise the necessary cash. Calculate the current price per share of the stock, the number of shares that must be sold, and the new price per share of the existing shares.

Experts Have Solved This Problem

Please login or register to access this content.