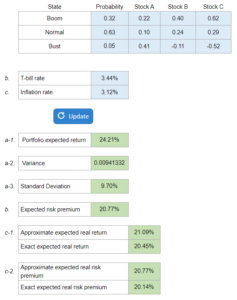

Problem 13.23 – Portfolio Returns and Deviations

With the given information, find the portfolio expected return, the variance, the standard deviation, expected risk premium, the approximate and exact expected real returns, and the approximate and exact expected real risk premiums.

Experts Have Solved This Problem

Please login or register to access this content.