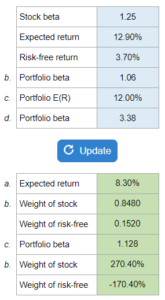

Problem 13.20 -Using CAPM

Find the expected return, the portfolio weights, and its beta with the given information of stock beta, expected return, and the risk-free asset.

Experts Have Solved This Problem

Please login or register to access this content.