Problem 13.07 – Engler Oil Company

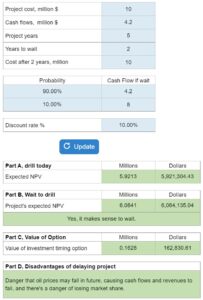

Determine the project's expected NPV, if the company chooses to drill today. Evaluate whether it makes sense to wait before deciding to drill and calculate the value of the investment timing option.

Experts Have Solved This Problem

Please login or register to access this content.