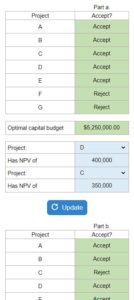

Problem 13.06 – Hampton Manufacturing Optimal Capital Budget

Determine the optimal capital budget and which projects the firm should undertake while assuming independent projects. For the second part, assume that two of the projects are considered mutually exclusive, and determine the set of projects that would correspond with the firm's optimal capital budget. Finally, redo the problem assuming the firm uses project risk differentials.

Experts Have Solved This Problem

Please login or register to access this content.