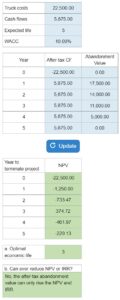

Problem 13.05 – Scampini Supplies Company

Determine if the firm should operate the truck until the end of its 5-year physical life, and if not, determine the truck’s optimal economic life.

Experts Have Solved This Problem

Please login or register to access this content.