Problem 12.27 – Photochronograph Corporation (PC) and Landman Corporation (LC)

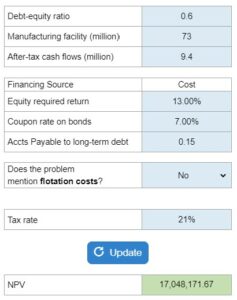

The firm is considering building a new manufacturing facility that will produce after-tax cash flows in perpetuity. What is the NPV?

Experts Have Solved This Problem

Please login or register to access this content.