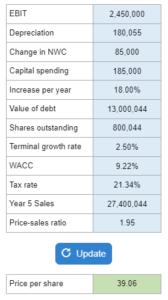

Problem 12.25 – Derry Corp. Terminal Value Based On Price-Sales Ratio

Given EBIT, depreciation, change in net working capital, capital spending, the value of debt, shares outstanding, WACC, tax rate, year-five sales, and price-sales ratio... find the price per share.

This problem is different than the other Derry Corp problem that uses the perpetual growth rate to estimate the terminal value. This one uses the price-sales ratio instead! Please be careful in unlocking the correct solver for your problem.

Experts Have Solved This Problem

Please login or register to access this content.