Problem 12.21 – Ariana, Inc.

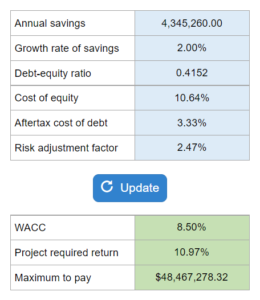

Given the initial aftertax cash savings from a project with growing savings, use the subjective approach to determine the project's required return and the maximum that the firm would be willing to pay for the project.

Experts Have Solved This Problem

Please login or register to access this content.