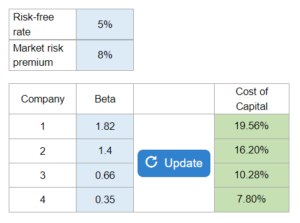

Problem 12.17 – CAPM and Expected Return

Given the table with the company and betas, risk-free rate of interest, and risk premium... find each company's expected rate of return using CAPM.

Experts Have Solved This Problem

Please login or register to access this content.