Problem 12-11, Overprice or Overpriced

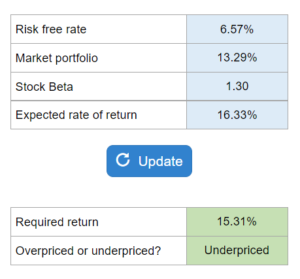

Given the risk-free rate, the rate of return on the market portfolio, the stock's beta, and the security's expected return determine the required return and state whether or not the security is overpriced or underpriced.

Experts Have Solved This Problem

Please login or register to access this content.