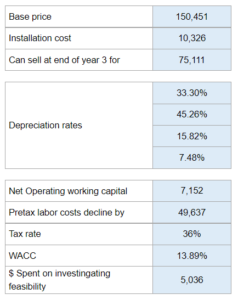

Problem 12.09 – Proposal to buy a new milling machine

You are asked to determine the feasibility of using the milling machine and compute the annual cash flows for the project for the investment outlay and for Years 1,2, and 3.

Experts Have Solved This Problem

Please login or register to access this content.