Problem 12.08 – Spectrometer for R&D Department

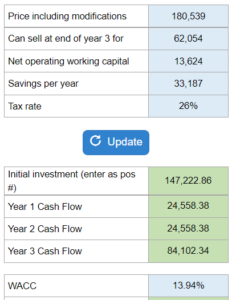

Given the purchase price, equipment selling price, required increase in NWC, before-tax labor costs, and tax rate... determine the initial investment outlay for the spectrometer for part a., the annual cash flows for years 1,2, and 3, and finally the NPV of the spectrometer.

Experts Have Solved This Problem

Please login or register to access this content.