Problem 12.06 – Charlene

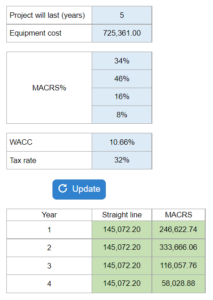

In this problem, you are asked to compare MACRS and straight-line depreciation methods for a capital budgeting problem. You are asked to compute depreciation expense each year and determine which method will produce a higher NPV for Charlene.

Experts Have Solved This Problem

Please login or register to access this content.