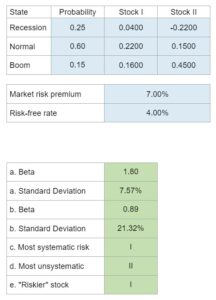

Problem 11.30 – Stocks I and II, Calculating Beta and Standard Deviation for Stocks

Determine the beta and standard deviation of Stock I and Stock II and determine which stock has the most systematic risk, the most unsystematic risk, and which stock is "riskier."

Experts Have Solved This Problem

Please login or register to access this content.